Our Verdict

3.5

Prudential is probably one of the best life insurers in terms of underwriting customers with complicated medical histories, including cancer and diabetes. They were also the first company to offer life insurance to customers who were HIV Positive.

This is why I put this Prudential Life Insurance Review together, to help you understand if this product is best for you and how it works.

Pros

Cons

If you have pre-existing conditions such as diabetes or HIV, or need more than $1 Million in life insurance you will probably need to complete a medical exam to get covered.

While I am a huge fan of no-exam options, sometimes it just won't fit your situation.

The best way to speed up the underwriting process if you must take an exam will be to get your exam completed as early as possible so that your results get back to the insurance company faster.

If you need the most affordable rates and are fine with a 1 to 2 week turn around, then getting term life insurance rates and coverage from Prudential is the best answer.

Who Is Prudential Life Insurance Company?

Prudential was founded in 1875 which makes it over 142 years old.

They have been named the best life insurance company by Fortune as well.

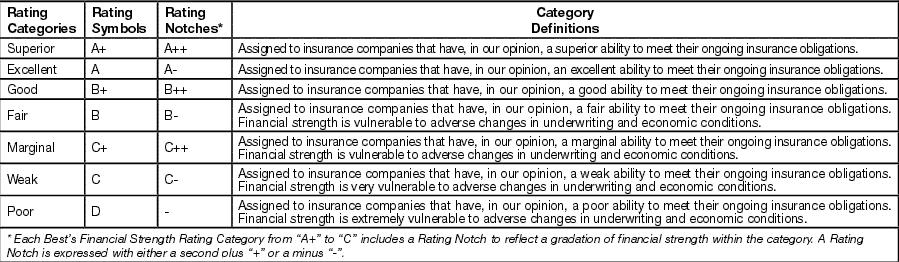

Prudential is rated A+(Superior) by A.M. Best.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

Why Should You Care About A.M. Best?

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years.

They rate companies based mainly on their financial strength, which can be an indicator or claims-paying ability.

Claims Paying Ability "in plain English": A Life Insurance Company's ability to pay out on a policy.

What Makes Them Different?

What makes Prudential different is that they have a specialized focus on people with pre-existing medical conditions.

If you have a complicated medical problem they will probably be able to get you coverage.

Prudential has coverage options as low as $100,000 up to $1,000,000+

INSURANCE WHERE YOU LIVE

Life insurance by state.

">How Does Prudential Life Insurance Work?

Prudential is focused on affordable life insurance rates with solid underwriting for people that could have health issues or be a tobacco user.

Their life insurance process works like this:

Electronic Application

The application process is online and electronic, simple and short, once you submit the application you will be sent to underwriting.

For final expense a paper application is needed.

Policy Delivered Via Regular Mail

Once your policy has been approved and issued you will have to wait for your policy in the mail.

The down side to this is the waiting and having to keep up with paper documents.

You might want to upload a copy of it to the cloud like with Google Drive.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

What Does Prudential Life Insurance Cover?

Prudential offers a few different policy options for you to choose from.

Each policy comes with coverage options from $100,000 up to $1,000,000+.

10 Year Term Life Policy

The ten year term life option is going to cover you for 10 years before it's time to purchase a new policy.

This policy is going to be the most affordable option with low-range pricing and will be best for people who are looking at both their short term and long term needs.

The amount of life events that can happen in 10 years is massive and being prepared for them is very important.

A 10 year term is a great starting point and locking your low rates in is going to be essential.

15 Year Term Life Policy

The fifteen year term life option is going to cover you for 15 years before you have to purchase a new policy.

This policy is going to be the second most affordable and be best for people who are in the middle of life events like having a baby or switching jobs.

20 Year Term Life Policy

The twenty year term life policy will be the second most expensive of the 4; however, it will still be very affordable.

This term length is going to be best for someone focused very much so on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the twenty year term option, then I would suggest you go with the 20 year term option.

30 Year Term Life Policy

The thirty year term life policy will be the most expensive of the 4; however, it will still be affordable.

This term length is going to be best for someone focused on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the thirty year term option, then I would suggest you go with it.

It's a really good option if you just purchased a home.

All Cause Death Benefit

All of these policies will pay out for all types of death from accidental death, terminal illness, critical illness or chronic illness.

With all insurance policies, there are some limitations so be sure to read the policy for things that aren't covered.

Return Of Premium Life Insurance

Prudential also offers a return of premium life insurance policy that allows you to have a forced savings account.

If you live past the term length the policy will pay back everything you put into it, and if you die before the policy ends, your death benefit will pay out.

Prudential Life Insurance Products

Prudential has one main product that we will detail below.

Prudential Term Essential

The Trendsetter Super product has very competitive underwriting for a range of health conditions.

It offers coverage for people between the ages of 18 to 75 and up to $1,000,000

in life insurance.

They have 10, 15, 20, 25, and 30 year term options available

There is also a wide selection of riders available to personalize your coverage and high limits for accelerated death benefit for multiple conditions.

You can also convert this policy into a whole life policy by following the below guidelines:

The policy is convertible to the lesser of level premium period (LPP) or to the first policy anniversary on or after your 65th birthday, but at least 5 years. Partial conversions are permitted

Some of the optional riders available are:

Child Protection Rider - This rider will cover all eligible children between the ages of 15 days and 18 years old. Available coverage up to $100,000.

Waiver Of Premium Rider - If you become totally disabled as a result of a qualifying event, premiums are waived for a fixed period of time.

Accelerated Death Benefit Rider - Advances part of the death benefit if you've been confined to a nursing home for 6 months and are expected to be in the nursing home permanently or you've been diagnosed with a terminal illness with a max life expectancy of 6 months.

Accidental Death Rider -Pays an additional death benefit on top of the base policy’s death benefit if the death resulted from qualifying accidental injuries.

INSURANCE WHERE YOU LIVE

Life insurance by state.

">Prudential HIV Life Insurance Requirements

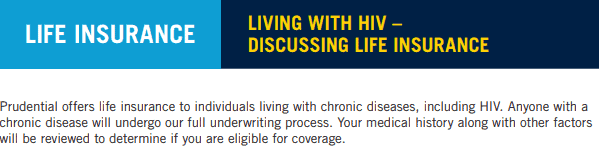

I have to give a round of applause for Prudential because they are surpassing almost all of their peers when it comes to insuring people with HIV.

Now, the requirements to get coverage are a bit extreme and you are going to be looking at higher monthly premiums.

However, it is very much worth protecting your family and having peace of mind.

Below is the exact requirements to get covered:

People living with HIV, following their physician recommendations, and who are free of complications from HIV with suppressed viral loads and stable CD4 levels are candidates to be considered for coverage.

However, like the general population, not everyone living with HIV will qualify.

An applicant living with HIV must be a permanent U.S. resident to be considered for insurance.

Other criteria used to determine eligibility include:

Treated

- 1A history of CD4 count < 200 is permitted if being successfully treated for more than five years.

- 2.CD4 count must have been > 500 after the initiation of treatment. CD4 must currently be at least 350, and stable.

Term Life

- 1No history of CD4 count ever being < 200, including at time of initial diagnosis

- 2CD4 count must be stable and > 500 for at least 1 year and with no physician plan to initiate treatment.

I know this may seem like a bit much but trust me, Prudential is the best way to go and if you have HIV and are pretty healthy you should be good for getting coverage.

Prudential Life Rates & Comparisons

Just to give you an idea, below I wanted to compare Prudential life rates with multiple companies.

A 20 Year, 500,000 Term Policy for a 30 year old male in perfect health and a non-tobacco user, see the results below:

Company Name | Plan Name | $500,000 Quote |

|---|---|---|

Classic Choice Term | $20.21/month | |

Pacific PROMISE Term | $20.84/month | |

TermAccel | $21.00/month | |

Select-A-Term | $21.11/month | |

Level Premium Term | $21.32/month | |

OPTerm | $21.44/month | |

Term Life Answers | $21.66/month | |

| Trendsetter Super | $22.36/month |

Haven Term | $22.48/month | |

Guaranteed Level Term | $24.12/month | |

Bestow No Exam Term | $26.25/month | |

Term Life Essential | $33.25/month |

Prudential comes in on the lower end for its monthly premium; however, if you have medical conditions you do have a much better chance of approval at much cheaper rates.

It is probably worth the small difference in premium to choose Prudential if you have any sort of pre-existing condition.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

How Prudential's Claims Process Works

Prudential makes it easy to file a claim online by just clicking here.

It takes about 5 minutes to complete the entire process.

You can also call 855-277-8061 Monday-Friday between 8 am and 8 pm EST if you need any help.

Are There Any Claim Exclusions

There are a few exclusions when paying out on a life insurance claim.

The exclusions include death from suicide (within the first 2 years of coverage), which is standard for almost all life insurance policies.

As always, please read the policy specifics when it arrives in the mail; however, those are some general exclusions which is industry standard for most policies.

Prudential Availability & Policy Options

To qualify for a Prudential life insurance product, you must:

How To Take Action

No other Prudential Life Insurance Reviews are as long as mine; however, I wanted to make sure that I gave as much detail as possible.

If you have been holding off on buying life insurance for any reason, I say give the 30-day free look period a shot.

Prudential has made it easy to apply for life insurance online and they are the best when it comes to pre-existing medical conditions.

Just click on the link below to get started.