Breeze has introduced the first fully-online and pain-free long-term disability insurance plan with extremely affordable rates.

When I first learned about disability insurance I was pretty shocked. I couldn't believe that I had gone so long without it.

I know for sure life would have been really hard if I would have become disabled without any type of coverage.

Our Breeze Disability Insurance Reviews:

Breeze Disability Insurance is backed by Assurity Group who is rated A- (Excellent) by A.M. Best. Breeze is hands-down, the fastest way to get quotes and buy disability insurance online.

That is why I created this review, to help you see how simple and fast Breeze makes it for you to apply online for instant long-term disability insurance coverage.

Who Is Breeze Long Term Disability Insurance?

I consider Breeze to be what I like to call, a NewTech Insurance Company.

A NewTech Insurance Company is an insurance company that creates a new buying process for their industry and sets a new standard.

This is exactly what Breeze has done.

There is no other company in the disability insurance industry that has created an automated underwriting system for a faster and more affordable buying process.

This company was built by a mixture of Disability Insurance Technology Marvels who have come together to create a solid product and an excellent process.

They are backed by the Assurity Group so if something were to happen to them, your policies would still be perfectly fine. Assurity has been around for over 125 years and has an A- (Excellent) rating from A.M. Best.

This is an important factor because when it comes to insurance you need to know that you can rely on an insurance company for their financial strength and longevity.

What Makes Breeze Disability Insurance Different?

What makes Breeze so different is that they are changing the way disability insurance is purchased, and what benefits should come standard with the average disability insurance policy.

Breeze is introducing a much easier, faster and seamless process by having a 100% online application and approval process.

You can get quotes within 30 seconds and apply online in minutes, and because everything is web based, on average, their premiums are coming in at a more affordable rate than other companies.

As I stated above, they are offering a more modern coverage by including things like partial disability and presumptive disability with their policies.

Why Should You Care About A.M. Best?

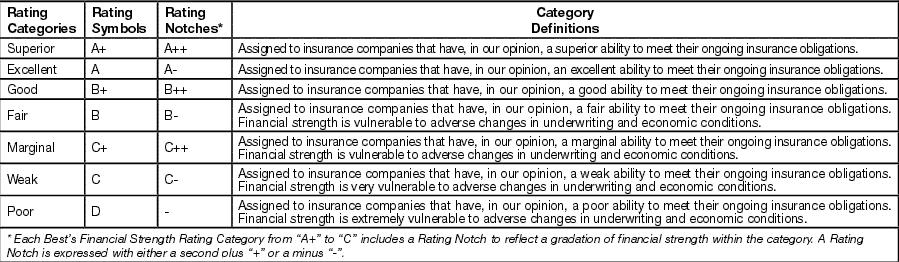

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years. They rate companies based mainly on their financial strength, which can be an indicator of claims-paying ability.

Below you can check out all of their different ratings:

THE SIMPLY INSURANCE WAY

Disability Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get disability insurance within minutes of getting your quotes and applying online.

Breeze Long-Term Disability Pros And Cons

Below is a list of some pros and cons of Breeze Long-Term Disability Insurance product .

Breeze Review - The Pros

Breeze Disability Review - The Cons

It's easy to see, the pros heavily outweigh the cons and honestly, isn't that what you want in a disability insurance company? With a ton of different policy options and combinations Breeze makes getting covered online very easy.

Breeze Disability Insurance Review

No one wants to file a claim for disability benefits.

However, if you are in the position that you have to file one, it's great to know what would be covered.

If you become disabled (through accident or illness) you can use your disability income benefit to cover things such as:

There is no limitation on what you can spend your disability income on, it is up to you.

What Does Breeze Cover?

Every policy offered by Breeze comes packed with free benefits and features that most disability insurance companies charge an additional fee for.

Below is a list of all the benefits that are included in their policies at No additional cost:

Free Benefits & Features

Partial Disability

If you are partially disabled and have resumed part-time employment after receiving benefits for being totally disabled, they will pay you a monthly benefit for up to 6 months. .

Presumptive Disability

If you lose your eyesight, limbs, hearing or speech, you don't have to worry about the waiting period. Breeze will start paying your benefits immediately

Home Modification

Some disabilities may require you to alter your home to meet your needs and this is covered in your policy as well.

Survivor Benefit

I really like this benefit because if you die after receiving disability benefits for at least

12 months, they will cut a check to your beneficiary.

This is how it works:

If you die after becoming disabled and have been receiving disability benefits for at least 12 consecutive months, the policy will pay a lump sum of 6 times the monthly benefit amount to your beneficiary.

So if you apply for $5,000 in base benefit, become disabled and collect $5,000 for 12 months and then pass away, a beneficiary would receive a $30k lump sum.

Typically this would be used for burial and funeral expenses but is a nice little perk that is included that can help out in a tough time.

Vocational Rehab

If you have been receiving disability benefits for 6 consecutive months, they will pay for a vocational rehabilitation program at an accredited college, university or school.

Organ Donor Benefit

If you become disabled after donating an organ or bone marrow, Breeze will cover that too as long as your policy has been in place for at east 6 months.

Waiver Of Premium

Renewal premiums will be waived on the first premium due date after the insured has been totally disabled for the elimination period or 90 days, whichever is shorter.

Any premiums paid during this period which became due after total disability started will be refunded.

Waiver of premium ends when the insured is no longer receiving disability monthly benefits. Premiums are not waived during a period of partial disability.

The best thing about all of the above benefits is that they are included with the policy at No Additional Cost. However, Breeze also has some additional optional riders that you can purchase at an additional cost.

INSURANCE WHERE YOU LIVE

Disability insurance by state.

Optional Riders

Automatic Benefit Increase

After one year of continuous monthly disability benefits payments, this rider increases the base policy monthly benefit by 5 percent of the original monthly amount each year benefits remain continuously payable, until the payment has increased to twice the original amount, at which point increases stop.

Catastrophic Disability Benefit

In the event you are cognitively impaired, need assistance to perform daily activities

and can’t work, they will help you hire the assistance you need

Critical Illness Benefit

If you receive a first-ever diagnosis or have a procedure for a critical illness including cancer, heart attack, stroke, kidney failure, organ transplant or paralysis, they will help cover some of the costs.

Guaranteed Insurability

The Guaranteed Insurability Rider gives you the option to increase your base policy monthly benefit by purchasing additional amounts of insurance.

Additional amounts will have the same benefit period and elimination period as the policy.

Increases do not require evidence of insurability and are based on your current income and the issue and participation limits in effect on the option date.

Premiums for the additional insurance will be based on your attained age and the current rates.

You cannot exercise an option if disabled or receiving benefits.

Non-Cancelable Rider

The Non-Cancelable Rider makes your policy and any attached riders non-cancelable.

Non-cancelable means that the insurance company cannot change the policy or riders by increasing the premiums or canceling prior to termination.

Own Occupation Rider

The Own Occupation Rider extends the own occupation period for the total disability definition from two years to the period selected.

Residual Disability Rider

Pays the residual disability monthly benefit if you are residually disabled and the elimination period has been satisfied by any continuous period of total and/or residual disability.

Benefits will continue and premiums will be waived until you cease to be residually disabled or to the end of the residual benefit period, whichever is first.

The residual disability monthly benefit is based on your percentage loss of prior income.

Supplemental DI Rider

The Supplemental Disability Income Rider will pay a monthly benefit less any social insurance benefits received, offset dollar for dollar, if you are totally disabled and the elimination period has been satisfied.

Benefits will be paid until you are no longer totally disabled or to the end of the maximum benefit period, whichever is first.

No benefits will be paid if social insurance benefits exceed the SDIR monthly benefit amount.

THE SIMPLY INSURANCE WAY

Disability Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get disability insurance within minutes of getting your quotes and applying online.

The Types Of Jobs Breeze Will Cover

Disability Insurance works a bit different from other insurance products in that a huge factor of determining your eligibility is based on your job category.

Breeze accepts 4 different job categories that range from Accountants to Bus Drivers, we detail them below:

Professional - Class 4A

The Professional occupation class includes professional or office-type occupations that are rarely exposed to physical or occupational hazards.

Some examples include the following:

- Accountant

- Architect

- Biologist

- Computer Programmer

- Office Clerk

- Nurse (RN/LPN - Clinic)

- Pharmacist

- Real Estate Agent

- Secretary

Riders & Options Available

If you are are in the Professional occupation class you have access to:

- All benefit periods available (1, 2, 5, 10, Age 65, Age 67)

- All waiting periods available (30, 60, 90, 180, 365 days)

- All riders available

Technical - Class 3A

The Technical occupation class includes occupations similar to the professional occupation but with certain activities or hazards involving laboratory, technical, supervisory, and work services.

Some Examples include the following:

- Auctioneer

- Clergy

- Dental Hygienist

- Event Planner

- Lab Technician

- Locksmith

- Nurse (RN/LPN - Hosp/Surgery)

- Sales Clerk

- Surveyor

Riders & Options Available

If you are are in the Technical occupation class you have access to:

- All benefit periods available (1, 2, 5, 10, Age 65, Age 67)

- All waiting periods available (30, 60, 90, 180, 365 days)

- All riders available

Light Labor - Class 2A

The Light Labor occupation includes skilled and manual occupations in lighter industries, along with most machine operators.

Some examples include the following:

- Auto Mechanic

- Beautician

- Bricklayer

- Carpenter

- Electrician

- Farmer

- Landscaper

- Plumber

- Tailor

Riders & Options Available

If you are are in the Light Labor occupation class you have access to:

- All benefit periods available (1, 2, 5, 10, Age 65, Age 67)

- All waiting periods available (30, 60, 90, 180, 365 days)

- Riders limited (no own occupation, no non cancelable)

Labor - Class 1A

The Labor class occupations include occupations involving heavy manual labor or unskilled workers where there is increased risk for accidents.

Some examples include the following:

- Auto Body Repair

- Bus Driver

- Construction Laborer

- Custodian

- Exterminator

- Furniture Mover

- Painter

- Roofer

- Used Car Dealership

Riders & Options Available

If you are are in the Labor occupation class you have access to:

- Only benefit periods (1, 2, and 5 year) available

- All waiting periods available (30, 60, 90, 180, 365 days)

- Riders limited (no own occupation, no non cancelable, no residual)

What Breeze Will Not Cover?

Pre - Existing Conditions & Certain Occupations

Just like with any disability insurance policy, Breeze will not cover pre-existing conditions.

They also have a list of occupations that aren't eligible for coverage that we have listed below:

- Armed Forces

- Athlete

- Author

- Bartenders

- Entertainer

- Longshoreman

- Pilot

- Self-Employed Artist

- Unemployed-Student

The cool thing is that there aren't many occupations that Breeze won't cover, next up we will discuss how much a policy can cost.

How Much Does Breeze Insurance Cost?

Your occupation, age, and benefit amount will play a direct part in how much your long term disability insurance will cost.

Below are some sample rates for a 34 Year Old non-tobacco user that makes $50,000 Per year:

- Female

Below are rates for a 34 Year Old non-tobacco Male that makes $50,000 Per year:

Occupation | Benefit Amount | Benefit Period | Waiting Period | Monthly Premium |

|---|---|---|---|---|

Professional | $2,980.00 | 5 Years | 90 Days | $31.00/month |

Technical | $2,980.00 | 5 Years | 90 Days | $41.00/month |

Light Labor | $2,980.00 | 5 Years | 90 Days | $65.00/month |

Labor | $2,980.00 | 5 Years | 90 Days | $83.00/month |

The above quotes are based on getting the maximum benefit amount for someone making 50k per year. However, you can make several changes after you get the quote.

THE SIMPLY INSURANCE WAY

Disability Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get disability insurance within minutes of getting your quotes and applying online.

Breeze Insurance Availability & Policy Options:

There are a few things to take note of with a Meetbreeze.com policy:

- Breeze policies are available to individuals ages 18 to 60 years old.

- Benefit amounts from as little as $500 per month up to $20,000 per month

- Your benefit periods can be 1, 2, 5 and 10 years , or payable to age 65 or age 67

- Choose between a 30, 60, 90, 180 and 365 day waiting period

- Policies are guaranteed renewable until the insured turns 65 or 67

- Available In All States

Breeze Claims Process

The claims process for Breeze is pretty straight forward, all you need to do is file a claim form and there are a few ways you can do this:

- Complete the online claim form

- File the claim inside your online account

And guess what:

If your income is under $4,000 per month they won't need to verify your income, and anything over $4,000 per month they will need either a paystub or tax return.

Overall this process couldn't be more simple.

Taking Action

No other Breeze Disability Insurance Reviews are as long as mine; however, I wanted to make sure that I gave you as much detail as possible.

If you have been holding off on buying disability insurance for any reason, I say give Breeze a try. You have nothing to lose, like all insurance product this policy has a 30 day free look period.

Just click here or on any of the above buttons to get started.