As a fellow pet parent, I'm sure you can agree that finding the best pet insurance for multiple pets would be beneficial because it helps to spread out the costs and reduces the overall financial burden that can come with owning a pet.

But here's the thing:

Searching for coverage on one pet can already be a challenge, so my primary goal in this post will be to review the best pet insurance companies for multiple pets.

Key Takeaways

We will also cover the average cost of pet insurance for multiple pets, and provide tips on how to quickly obtain coverage for multiple cats, dogs, and exotic animals in 2024.

What Is The Best Pet Insurance For Multiple Pets?

The best company for multiple pets is going to depend on several factors such as your budget, the type of coverage you are looking for, and the type of pets you have. Our top pick is Progressive, however, our detailed chart below provides more information and compares what other pet insurance providers offer.

Get Pet Insurance Quotes For Multiple Pets Today!

Multi-Pet Insurance Plan Comparison Table

Company | Coverage Amounts | Deductible Options | Reimbursement Options | Multi-Pet Discount |

|---|---|---|---|---|

Spot | $2,500 / $3,000 / $4,000 / $5,000 / $7,000 / $10,000 / Unlimited | $100 / $250 $500 / $750 / $1,000 | 70% / 80% / 90% | 10% |

Progressive Pet Insurance By Pets Best | $5,000 / Unlimited | $50 / $100 / $200 / $250 / $500 / $1,000 | 70% / 80% / 90% | 5% |

Nationwide | $10,000 | $250 | 50% / 70% | 5% |

Many Pets | Unlimited | $500 / $750 / $1,000 | 70% / 80% | 5% |

Lemonade | $5,000 / $10,000 / $20,000 / $50,000 / $100,000 | $100 / $250 / $500 | 70% / 80% / 90% | 5% |

Healthy Paws | Unlimited | $100 / $250 / $500 | 70% / 80% / 90% | None |

Geico | $5,000 / $8,000 / $10,000 / $15,000 / Unlimited | $100 / $250 / $500 / $750 / $1000 | 70% / 80% / 90% | 10% |

Embrace | $5,000 / $8,000 / $10,000 / $15,000 / Unlimited | $100 / $250 / $500 / $750 / $1000 | 70% / 80% / 90% | 10% |

ASPCA | $2,500 / $4,000 / $7,000 / $10,000 | $100 / $250 / $500 | 70% / 80% / 90% | 10% |

More of the Best Pet Insurance Companies For Multiple Pets

ManyPets | Best Pet Insurance for Multiple Dogs:

A fresh face in the game, ManyPets brings uniqueness and value to the table. Their coverage features are unparalleled, offering comprehensive protection for your furry friends. But what sets them apart is their highly competitive pricing, and their unlimited maximum annual coverage amount, making it a compelling choice for pet owners. They also offer multi pet discounts.

If you're looking for a pet insurer that provides accident and illness coverage, it's worth exploring their offerings.

Key Features:

- Multi Pet Discounts: Up to 15%

- Maximum Coverage Amounts: Unlimited

- Deductible Options: $500, $750, $1000

- Reimbursement Options: 70%, 80%

Geico | Best Pet Insurance For Multiple Cats:

GEICO dominates when it comes to pet insurance for multiple cats. They offer many options including an unlimited annual coverage amount. Choose the best policy for you and enjoy a deductible as low as $100 and up to 90% reimbursement for veterinary costs.

GEICO offers an optional Preventive Care plan which covers microchip implants, prescription diet food, and vaccines. While there are no specific age requirements for spaying or neutering, enrolling your pet in a policy at that time earns you a discount.

Key Features:

- Multi-Pet Discounts: 10%

- Maximum Coverage Amounts: $5,000, $8,000, $10,000, $15,000, Unlimited

- Deductible Options: $100, $250, $500, $750, $1,000

- Reimbursement Options: 70%, 80%, 90%

Healthy Paws | Best Multiple Pet Insurance With Unlimited Coverage

Healthy Paws shines as the go-to for affordable rates and unlimited annual coverage caps. Their comprehensive and flexible plan impresses, but lacks routine care add-ons and customizable benefits for older pets.

If your furry friend is 6 years or older, consider Lemonade, Embrace, or even PAWP as alternatives for tailored coverage.

Key Features:

- Maximum Coverage Amounts: Unlimited coverage

- Deductible Options: $100, $250, $500

- Reimbursement Options: 70%, 80%, 90%

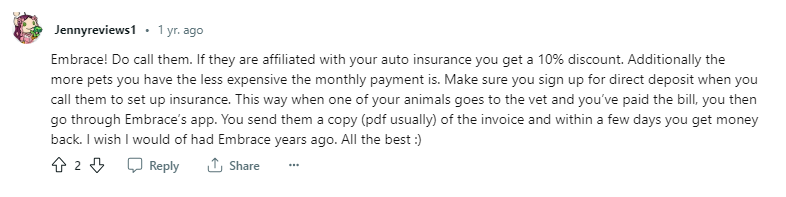

Embrace Pet Insurance | Best Pet Insurance For Multiple Pets Reddit:

Embrace is a fan favorite on Reddit. They provide a total care accident-and-illness plan that covers a wide range of medical needs for your pets.

This inclusive plan includes coverage for injuries, illnesses, chronic conditions, hip dysplasia, and various other health concerns.

Additionally, Embrace also covers alternative therapies, cancer treatments, emergency care, surgery, diagnostic procedures, physical therapy, and more.

Key Features:

- Multi Pet Discounts: 10%

- Maximum Coverage Amounts: $5,000, $8,000, $10,000, $15,000, or Unlimited

- Deductible Options: $100, $250, $500, $750 or $1,000

- Reimbursement Options: 70%, 80%, or 90%

ASPCA Pet Health Insurance

Ensuring the health and well-being of our furry friends is a top priority. That's why having reliable and comprehensive coverage is crucial. When it comes to insuring multiple pets, ASPCA Pet Health Insurance shines as the ideal choice when looking for an insurance company.

With its combination of attractive features, such as a multi pet discount and customizable options, ASPCA offers peace of mind and financial protection for all your beloved companions making it one of the best pet insurance companies.

Key Features:

Multi Pet Discounts: 10%

Maximum Coverage Amounts: $2,500, $4,000, $7,000, $10,000

Deductible Options: $100, $250, $500

Reimbursement Options: $70%, 80%, 90%

Nationwide | Best Pet Insurance for Multiple Exotic Pets Or Animals:

Nationwide stands alone in the world of insurance, providing coverage for exotic pets. They offer coverage for birds and exotic pets, including rabbits, guinea pigs, ferrets, pigs, lizards, reptiles and frogs. Their plans safeguard a diverse range of unusual companions.

Nationwide delivers discounts based on the number of pets enrolled—5% for two or three, 10% for four or more. Unlike competitors, no choices exist for coverage levels or deductibles. Nationwide's policy settles at $10,000 maximum coverage and a $250 deductible.

Their Wellness Coverage Plans cater to behavioral examinations, treatments, and the implantation of microchips. For long-standing conditions, the Whole Pet or Major Medical package ensures coverage, making it particularly suitable for senior pets.

Key Features:

- Multi Pet Discounts: 5%

- Maximum Coverage Amounts: $10,000

- Deductible Options: $250

- Reimbursement Options: 50% / 70%

Spot Pet Insurance | Best Low Cost Pet Insurance for Multiple Pets

Having reliable additional pet insurance is essential. While ASPCA Pet Health Insurance claims the top spot for the best insurance for several pets, there is another strong contender in the market—Spot.

Spot is a noteworthy choice for pet owners with multiple furry companions looking for annual coverage.

- Key Features:

- Multi Pet Discounts: 10%

- Maximum Coverage Amounts: $2,500, $3,000, $4,000, $5,000, $7,000, $10,000, or Unlimited

- Deductible Options: $100, $250, $500, $750 or $1,000

- Reimbursement Options: 70%, 80%, or 90%

Lemonade Pet Insurance | Best Multiple Pet Insurance With Wellness Care

With its unique approach and user-friendly platform, Lemonade is another great choice for insuring multiple pets.

Lemonade offers numerous options and an easy process for filing claims. Plus, its price-match guarantee ensures that you’ll get the best rates for your insurance needs.

- Key Features:

- Multi Pet Discounts: 5%

- Maximum Coverage Amounts: $5,000, $10,000, $20,000, $50,000, or $100,000

- Deductible Options: $100, $250, or $500

- Reimbursement Options: 70%, 80%, or 90%

What Is The Average Cost Of Pet Insurance For Multiple Pets Per Month?

The average cost of pet insurance for multiple pets is $77 per month or about $922 per year. These rates include the industry average 10% multi-pet discount.

However, keep in mind that when it comes to insuring more than one pet, the cost of insurance can vary and premiums can range between $59/month to $112/month depending on certain factors.

Understanding these factors can help us estimate the expenses involved in getting coverage for our furry companions. Below we explore the primary factors that influence the cost of insurance for more than one pet:

How Much Is Pet Insurance For Multiple Cats Per Month?

$53 per month is the average cost of pet insurance for multiple cats which is around $639 per year. This rate includes the average ten percent multi-pet discount as well. By now, it's probably easy to see that cats often secure lower insurance rates than their canine counterparts.

How Much Is Pet Insurance For Multiple Dogs Per Month?

Pet insurance for multiple dogs costs around $106 per month or just around $1,272 per year. Now, if you're wondering why dogs pay more per month in monthly premiums it has everything to do with overall health and life expectancy.

Company | Type Of Pet | Monthly Cost For Two Pets | Annual Cost For Two Pets With | Multi-Pet Discount | Multi-Pet Cost w/ Discount |

|---|---|---|---|---|---|

Pets Best | Dog | $100 | $1,200 | 5% | $95 |

Cat | $53 | $636 | 5% | $50 | |

ASPCA | Dog | $112 | $1,344 | 10% | $101 |

Cat | $59 | $708 | 10% | $53 | |

Embrace | Dog | $116 | $1,392 | 10% | $104 |

Cat | $61 | $738 | 10% | $55 | |

Spot | Dog | $118 | $1,416 | 10% | $106 |

Cat | $63 | $750 | 10% | $56 | |

Healthy Paws | Dog | $112 | $1,344 | None | $1,344 |

Cat | $60 | $720 | None | $720 | |

Average Totals | Multiple Dogs | $112 | $1,339 | 10% | $1,272 |

Multiple Cats | $59 | $710 | 10% | $639 | |

Multiple Pets | $85 | $1,025 | 10% | $922 | |

Source: The above premiums are based on data compiled for multiple cats and dogs with unlimited annual coverage, a deductible of $100 and reimbursements back to pet parents of 80% or the closest options available. | |||||

Is Pet Insurance Worth It For Multiple Pets

Insurance offers a vital safety net when hefty vet bills are beyond your means. Consider additional plans for wellness and preventive care if you are looking for pet insurance for 2 dogs.

While setting money aside is an option, an unexpected vet expense can cripple your finances, like the staggering $3,500 average cost of treating a dog who ingested a foreign object.

What Is A Good Annual Limit For Pet Insurance for Multiple Pets?

The annual coverage limit is the maximum amount that the insurance company will pay per year for covered expenses.

You usually have the option to choose a limit between $2,000 and $10,000, although some companies offer even higher limits. For instance, Lemonade provides options up to $100,000 per year, while Embrace, Figo, Pets Best, Pumpkin, and Spot offer unlimited coverage.

Keep in mind that higher annual limits come with higher costs for coverage. The limit will reset at the start of each policy year.

On average, insuring more than one pet is about 30% less than what you would pay to insure each pet separately.

Important Considerations when Shopping for Multi-Pet Insurance Policies:

It is an invaluable investment for a dog owner, providing financial protection and peace of mind. Insuring them under a multi pet coverage policy can simplify the process and potentially save you money.

However, there are several important considerations to keep in mind when shopping for policies to ensure you make the right choice for your furry companions.

The main things to consider are:

- Options Available: One of the most critical factors to consider is the coverage provided by the insurance policy. Each pet may have different health needs, so it's crucial to find a policy that offers total care for a wide range of conditions, including accidents, illnesses, hereditary conditions, and routine care.

- Customizability: As pet parents, we recognize that each pet has unique characteristics and requirements, and their insurance coverage should reflect that. Look for a policy that allows you to customize the coverage for each pet. This could include adjusting the coverage limits, deductibles, or reimbursement percentages to suit each pet's specific needs

- Premiums and Discounts: Evaluate the costs from different providers and evaluate the discounts offered for multi-pet policies. Look for insurance companies that provide competitive pricing and substantial discounts for insuring all of your pets.

- Reimbursement Policies: Pay attention to the reimbursement options available, such as the percentage of the veterinary bills that will be reimbursed (commonly ranging from 70% to 90%). Ensure you are comfortable with the reimbursement percentage and understand the claims process, including any required documentation or timeframes.

- Network of Providers: Ensure that the policy you want will allow you to visit licensed veterinarians of your choice, providing flexibility and accessibility to quality care for all your furry companions.

- Policy Limitations and Exclusions: Thoroughly review the policy's limitations and exclusions to understand what is and isn't covered. Pay attention to pre-existing conditions, waiting periods, and specific breed-related exclusions. Knowing these limitations will help you make an informed decision and avoid any surprises or disappointments in the future.

What Are The Most Common Pet Insurance Claims?

List some common dog or cats health problems in 2022 according to Embrace:

- Vomiting

- Diarrhea

- Urinary Tract Infection

- Weight Loss

- Otitis Externa (ear infection)

Without insurance, consider the weight of vet bills. Simple afflictions like ear infections or upset stomachs come at a price lower than a year's insurance premium. However, when faced with multiple ailments or graver conditions, expenses often surpass the coverage of a complete policy.

MetLife's claims data discloses that the average cost for common dog treatments rests at $254, while for cats, it stands at $267.

Yet, more prevalent issues like parvo treatment for puppies can prove expensive, with average claims exceeding $1,100. And though rarer, the diagnosis and treatment of cancer inflict substantial costs; chemotherapy alone can tally thousands of dollars.

Most Common Pet Insurance Claims For Cats

Rank | Condition | Vet Cost |

|---|---|---|

1 | Urinary tract infection | $295 |

2 | Upset stomach | $385 |

3 | Kidney failure | $485 |

4 | Diarrhea | $203 |

5 | Allergies | $235 |

6 | Diabetes | $276 |

7 | Colon issues | $203 |

8 | Ear infection | $149 |

9 | Upper respiratory infection | $219 |

10 | Hyperthyroidism | $216 |

Most Common Pet Insurance Claims For Dogs

Rank | Condition | Vet Cost |

|---|---|---|

1 | Ear infection | $149 |

2 | Allergies | $249 |

3 | Skin infection | $175 |

4 | Upset stomach | $385 |

5 | Diarrhea | $203 |

6 | Bladder issues | $617 |

7 | Eye infection | $115 |

8 | Arthritis | $255 |

9 | Hypothyroidism | $123 |

10 | Sprains | $267 |

What Exactly Are Multiple Pet Insurance Plans

A multiple pet policy, also known as a multi pet discount is a type of insurance that allows you to insure all pets under a single policy. Instead of purchasing separate policies for each pet, multi pet insurance plans provide coverage for all your pets, typically at a discounted rate. Vet bills are expensive.

What Does A Multiple Pet Insurance Plan Cover

Multi pet plans offer coverage similar to standard policies, including unintentional injuries, accidents, illnesses, and various other causes. They are designed to safeguard your pets from the financial burden of medical expenses, including surgical procedures, medications, and examinations. It provides a detailed description of covered accidents, ensuring that unexpected incidents are taken care of.

Moreover, in certain cases, your policy may cover treatment if the incident occurs in the presence of contaminated animals or toxins. It also includes coverage for cuts, fractured bones, and other irregularities that may affect your pets' well-being.

Additionally, the policy extends coverage to encompass serious illnesses such as earworm infections, vomiting, diabetic heart conditions, and diabetes. It further includes hereditary disorders like diabetes, heart disease, or skin cancers. With the right coverage in place, you can have peace of mind knowing that your pets are protected from unexpected medical expenses and can receive the necessary care when they need it most.

Do Pet Insurance Plans Cover Preexisting Conditions?

The Pet Protection Agency's pet policies do not cover existing conditions. Pet Insurance companies consider pets with these ailments as expensive investments and high risks. Some companies also differentiate between cure and incurability. It'll cover the curable conditions and stipulates generally if the dog does not experience any symptoms.

Does a Pet Insurance Plan Have Any Waiting Periods?

Company | Accident Waiting Periods | Illness Waiting Periods | Extended Waiting Period |

|---|---|---|---|

ASPCA | 14 days | 14 days | None |

Embrace | 2 days | 14 days | 6 months for orthopedic conditions for dogs |

Geico | 2 days | 14 days | 6 months for orthopedic conditions for dogs |

Healthy Paws | 15 days | 15 days | 12 months for hip dysplasia; not covered if your pet is age 6 or older at time of purchase |

Lemonade | 2 days | 14 days | 6 months for cruciate ligament issues |

Many Pets | 15 days or 24 hours | 15 days or 24 hours | None |

Nationwide | 14 days | 14 days | 12 months for cruciate or meniscus injuries |

Pets Best | 3 days | 14 days | 6 months for cruciate ligament issues |

Spot | 14 days | 14 days | None |

Source: The above premiums are based on data compiled for multiple cats and dogs with unlimited annual coverage, a deductible of $100 and reimbursements back to pet parents of 80% or the closest options available.

The Benefits of Multiple Pet Insurance

Pets bring us an endless amount of joy and comfort. After all, they are loyal companions who make our lives better in so many ways. However, pet ownership can be relatively expensive when you factor in the cost of food, regular check-ups, and unexpected health-related expenses.

Unfortunately, when you own several pets, these costs can add up quickly, making it challenging to take proper care of them. That's where you can let your pet insurance work for you and make life easier for both you and your pets!

Save Money By Enrolling Multiple Pets

One of the most significant benefits is that it's incredibly cost-effective compared to buying separate insurance policies for each pet.

Many pet insurance companies offer a discounted rate when you buy a plan that covers many pets, which can help you save a significant amount of money over time. This cost reduction can provide you with peace of mind that you're taking the proper care of your pets without breaking the bank. Vet visits are not cheap.

Comprehensive Pet Insurance Plans

This type of coverage can include illness, elective procedures, emergency visits, routine wellness care, and much more. These plans make sure all your pets are getting the same high-quality care they deserve.

Convenience Of Having Coverage For More Than One Pet

Some people may find it challenging to manage their pets' insurance policies, especially when it comes to keeping track of premiums, deductibles, and coverage limits.

However, with an insurance policy for several pets, you have the convenience of having all your pets covered under a single policy. This single policy makes everything more manageable, from paying premiums to filing claims.

Flexibility To Customize Your Combined Pet Insurance Policy

Other providers offer the added advantage of tailor-made policies to meet the needs of each pet's unique needs. Pets come with their own set of health issues, even within the same species or breed.

A customizable policy ensures that your pets get the care they need even when they have individual health concerns. As such, you will only pay for coverage that matters, avoiding overpaying for unnecessary coverage.

Having The Right Pet Insurance Coverage Provides Peace Of Mind

As dog owners, we love and care for our pets like they're our family. Nothing gives us peace of mind than to know that our furry friends are safe and taken care of.

Multiple pet insurance offers the peace of mind that comes with knowing that all your pets are covered by a comprehensive policy or accident and illness plans.

Additionally, extensive and reliable coverage takes into account the unpredictability of life and offers you financial support whenever your pet needs immediate medical attention.

As pet parents, you want to do everything in your power to make your pets' lives happy and comfortable. Multiple pet insurance helps ease the financial burden, provides comprehensive care, and ensures that your pets have access to medical attention whenever they need it.

This is one of the best pet insurance plans because the coverage is convenient, cost-effective, and customizable to your individual pets' needs. It's a great way to provide assurances to your pets' health while offering added benefits to your wallet.

Discounts Available for Multi-Pet Insurance Policies

Chart Available

For pets with more than one pet, a provider provides discounts on the insurance premium for each pet you enroll. The following table shows your savings in different companies. As pictured many (but not all) insurance companies give discounts to pets and their rates are often variable depending on the company.

Some offer discounts as big as 15% while other businesses such as Trupanion offer no discounts for additional pets whatsoever. Let's explore how these multi pet discounts work.

Multiple Pet Insurance Discount Comparison

It is important to compare the discounts offered by different companies to select the best plan for your needs. Additionally, other factors can influence the cost, such as the age and breed of your pets. Therefore, you must understand all the factors and consider your circumstances to ensure that you get the right coverage. Multi pet policies are a great way to provide comprehensive and reliable coverage for all of your furry friends. With discounts offered for more than one dog or cat, this type of policy is more affordable than needing separate policies for each pet.

Multiple Pet Insurance Discount Comparison Chart

Company | Multi-Pet Discount |

|---|---|

ASPCA | 10% |

Embrace | 10% |

Geico | 10% |

Healthy Paws | None |

Lemonade | 5% |

Many Pets | 15% |

Nationwide | 5% |

Pets Best | 5% |

Spot | 10% |

How Do I Buy A Multi Pet Insurance Policy Online?

To find the best policy, gather quotes from different companies and compare them. Visit each company's website and provide details like your pet's age, breed, species, and size to get accurate quotes.

If you prefer, you can call and speak to an insurance agent who can address any queries you may have.

Nationwide, for example, offers the option of in-person service through local agents. Comparing quotes allows you to discover options that suit your budget and cater to your multiple pets.

In 2023, the best way to buy pet insurance is online. This is where we come in.

Begin by researching the top pet insurance companies for multi-pet insurance. At the beginning of this article, we provide a list of reputable providers with solid records and good reviews. Compare coverage options, if you have an additional pet then a multiple pet plan would be best for you instead of a single pet plan.

- Examine exclusions and limitations. Understand uncovered treatments and waiting periods to avoid surprises. Request multiple quotes from different providers for multiple dog pet insurance or multiple cat pet insurance.

- Compare coverage and price. When you are looking to purchase you should first determine if you will need pet insurance for two cats or pet insurance for two dogs.

- Consider cost and affordability. Find a plan with good value that fits your budget. Read customer reviews and testimonials to understand satisfaction levels. Evaluate customer service, responsiveness, and claims processes.

- Seek recommendations from fellow pet owners or veterinarians. Review policy terms and conditions, paying attention to waiting periods and pre-existing conditions. Make an informed decision, choosing the best policy for most pet parents.

Remember to understand your policy thoroughly and keep coverage up-to-date. Regularly review and adjust as needed to meet your pets' evolving needs.

First, you must find a trusted company to help you compare pet insurance for multiple pets. Well, you found us! Let's review how to buy a multi-pet policy in 2023.

First, you have to get multiple quotes from several pet insurance companies. Request quotes from different insurance providers. Provide accurate information about your pets, including their age, breed, and any pre-existing conditions. Compare the quotes based on coverage and price to find the best balance.

Secondly, while price shouldn't be the sole determining factor, it's important to consider the cost of the policy. Look for a plan that provides good value for the coverage offered and fits within your budget. Consider factors such as monthly premiums, deductibles, and co-pays.

Next, read reviews or testimonials from existing customers of the insurance providers you're considering. This can give you insights into their customer service, claims process, and overall satisfaction. Ask fellow pet owners, friends, or your veterinarian for recommendations on policies. They may have firsthand experience or knowledge that can help you make an informed decision.

Once you have compared different providers, considered the coverage provided, and assessed affordability, It's time to take action. Choose the policy that best aligns with your requirements and provides complete coverage for your pets.

Frequently Asked Questions About Multiple Pet Insurance

Yes, most pet insurance companies allow you to cover more than one pet. Essentially, you would be placing all your pets on the same policy. Pet insurance companies prefer this method and usually give discounts for insuring multiple pets. In fact, you can now even cover multiple exotic pets through some of the more recent companies.

If you are a new customer, get a quote, enter details for the first pet, and click the 'Add another pet' button on the form. You will be asked to select a plan for the first pet, followed by any additional pets.

A major disadvantage would be pet insurance doesn't cover pre-existing conditions, so once your pet is sick, it's too late to sign up for coverage for that specific ailment. Additionally, there are usually multiple exclusions and limits to pet insurance policies. Also, if your pet needs to visit the vet you will be responsible for the fees upfront and then get reimbursed from the insurance company after.

To find the best pet insurance, gather quotes from different companies and compare them. Visit each company's website and provide details like your pet's age, breed, species, and size to get accurate quotes. If you prefer, you can call and speak to an insurance agent who can address any queries you may have. However, we believe the best method is to get pet insurance quotes online right here.

First, Nationwide is currently the only insurance company that covers exotic animals, pets, and birds. The cost of a policy will vary based on the type of pet, its age, and where you live. It's best to get a quote from Nationwide. However, based on the quotes we received, the rates generally range from $13 to $50 per month. This falls within the average cost range of pet insurance for dogs and cats, which is usually around $30 to $50 for dogs and $15 to $30 for cats. There are instances where a policy for a rare exotic pet will cost more than one for an ordinary breed of bird.

It depends on your specific situation if health coverage for your feline companions is worth it. Having pet insurance for multiple cats can help you manage the financial impact of unexpected veterinary expenses. Having coverage for treatments such as surgeries, x-rays, and other medical procedures helps significantly to reduce the financial burden of pet care. As long as your cats are not excluded due to pre-existing conditions or age restrictions, they can get the care they need.

If your pet already has a health issue, the insurer may not reimburse you for any treatments directed toward that specific ailment. However, you still have the option to get treatment for that condition, and you could receive compensation for treatments related to other health issues your pet has.

Depending on your pet insurance coverage type, you can still get pet insurance to cover future injuries and/or illnesses your pet may experience even though you may not be able to get reimbursed for treatments related to that particular condition.